Insurance

Or a transparent look at our financial situation after the Marshall Fire.

Ok, we’re about to get to know each other really well. We’re going to talk about our money, and that’s usually a topic reserved for only the closest of relationships.

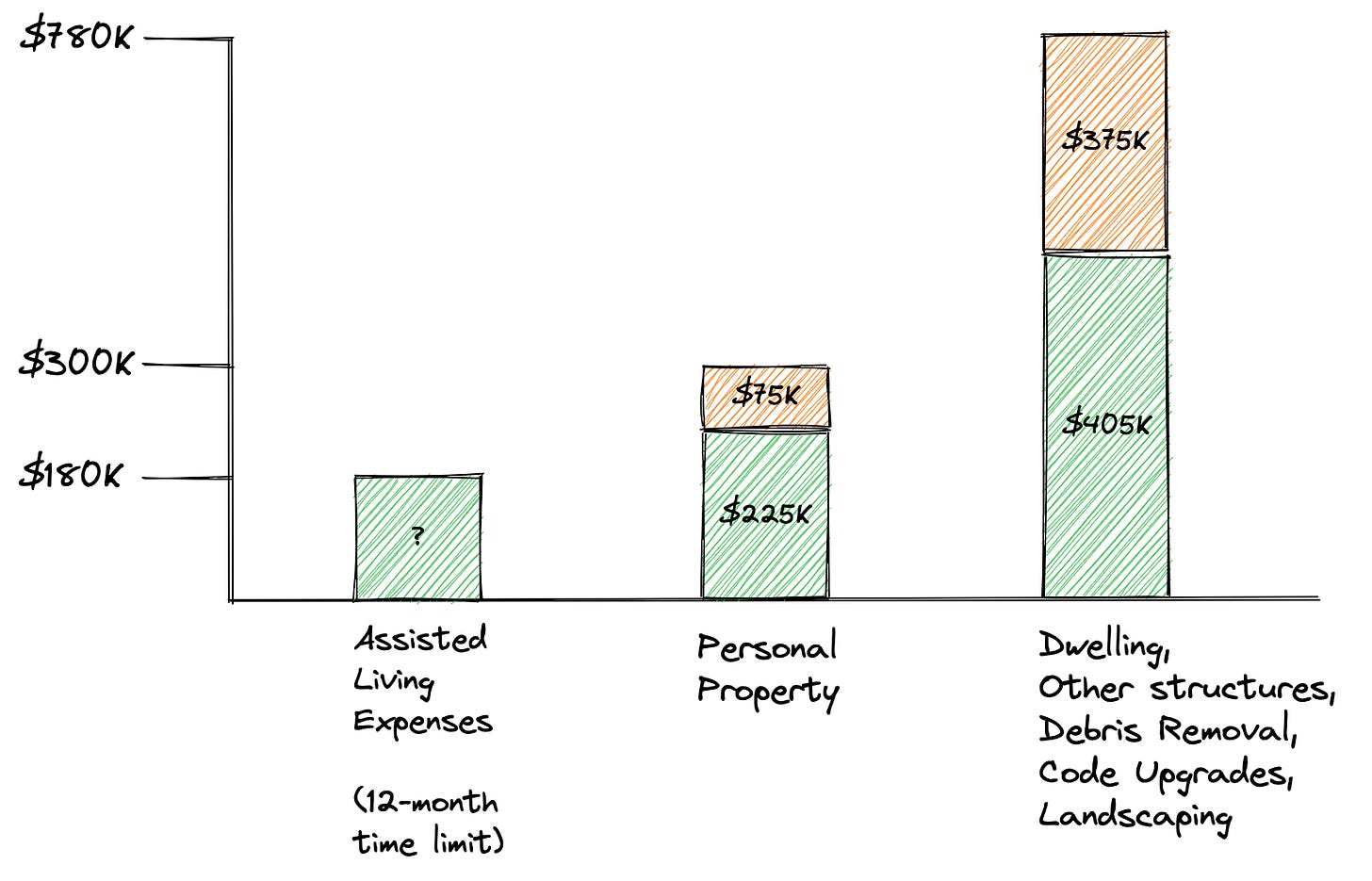

To frame things, I’m going to explain how our homeowner’s policy works so you can understand what we’re fighting for. Our policy is broken into three major components, Assisted Living Expenses (ALE), Personal Property, and Dwelling. Based on the copious notes we’ve exchanged with our neighbors, this seems to be the standard set of categories, which hopefully means what we share here extrapolates to most scenarios.

We are insured with Homesite via Geico for those of you who wonder. Here’s a summary of our policy:

Assisted Living Expenses

Limit: $180K. Timeline: 12 months.

When your house burns down or is otherwise damaged to a point where you can’t live in it anymore, Assisted Living Expenses kicks in. It’s the amount of money an insurance company will pay for you to live somewhere else while you rebuild and pull your life back together. Our policy will cover up to $180K, which blew me away. I mean, we could live in a palace somewhere no?

No.

The policy grants us allowance for a structure of like quality and kind. In our case, that precludes castles and rentals on Spruce St. We’re renting a house in East Boulder for $4K per month.

I will say, I’m delighted by how our insurance company has responded here. They’re paying our rent directly to the landlord. Our lease was approved within hours after I emailed it to them (insurance companies want to make sure renters aren’t being gouged, which happens. So they need approve leases).

But it ain’t all pretty. I found out two days ago that our policy has a 12-month time limit, meaning they’ll stop covering our rent a year after the first month of the lease. On January 7, 2022, Colorado passed Emergency Regulation 22-E-01 which made it unlawful for insurance companies to impose ALE time limits (go Jared). I sent this information to our insurance company a couple of days ago, and they’re figuring out what to do as that was the first they’d heard of it. Fun.

Here are the details of the regulation for that one lawyer reading this post:

Personal Property

Limit: $300K. Payout (so far): $225K.

On 31 December (NYE), the day after the fire, our insurance company called us proactively and offered a $10K advance against our Personal Property claim. I was floored by their proactivity. I received a link in my inbox minutes later, entered my account information, and the money just appeared.

Magic.

A week later our adjuster offered to pay out 75% of our limit, or $225K. After she assured me that receiving the money didn’t indicate we were settling, I agreed. And then the same magical thing happened. Inbox. Link. Account. Money (well, Money - the $10K we already received).

Seriously. $215K is just sitting there in our Savings Account.

So, how do we get the other $75K? Well, first we need to believe we actually had $300K worth of possessions in our house. And if we do, we need to itemize. That’s right. Shower curtain holders. The Boosted Board. Our expensive art. Those leather chairs you see above. The bookshelf, with all of the books listed by title and author, each with a dollar amount. And when we’re done, and when the insurance company takes depreciation off the value of each item, the sum must be >= $300K.

Worth it? Maybe. Probably. We’ll do that later.

Dwelling*

Limit: $780K. Proposed ACV Payout: $406K. Recoverable Depreciation: $252K.

How much money will our insurance company pay us to get this, or something comparable, back? Welcome to the Dwelling portion of the policy. This is the anchor for the whole thing. And this is where most people become severely disappointed with their insurance companies.

So far, we are too.

Explaining the policy.

First, the asterisk (*). I’ve lumped categories called Other Structures, Debris Removal, Code Upgrades, and Landscaping into Dwelling. We shall henceforth use a capital D with the word to denote this aggregate definition. I think it simplifies things, here at least, as these all comprise the costs to re-introduce all those objects that compose a house both inside and out.

Second, everything starts with Replacement Cost Value. This is how much the insurance company thinks it’ll cost to replace the Dwelling. They all use an estimation program called Xactimate to calculate this value.

Third, there exists an important insurance term called Recoverable Depreciation. It’s an amount, calculated based on the age of things, that the insurance company will withhold from the Replacement Cost Value. As you rebuild, you can ask for it (or your builder can), and the insurance company will release funds if it agrees with the request. They do this to limit fraud and ensure we actually use the funds to rebuild.

Fourth is Actual Cash Value (ACV). It’s what’s left when we subtract Recoverable Depreciation from the Replacement Cost Value. Insurance companies write a check addressed to the insured and the insured’s mortgage company for ACV amount.

Our mortgage.

Yes, the check is also addressed to the mortgage company. We still have a loan. And it’s secured against an asset that’s supposed to be both structure and land. Since the structure is gone, we just have land. The mortgage company is entitled to hold on to our ACV payout as we build. And they’ll release funds as we need them, too.

If you’re connecting the dots, as I’ve just done, that means as we rebuild, we have to appeal to our mortgage company and our insurance company for funds to cover building expenses as they’re incurred. Pain. In. The. Arse. Well, a pain in the arse unless we pay off our mortgage and get them out of the way. And this, my friends, is exactly our plan.

Bye bye mortgage.

Ok, so how do we get rid of the mortgage company? Well, we owe $477K on our thirty-year fixed loan. Our plan is to use our ACV check for the Dwelling to pay off our mortgage. Then we become the proud owners of dirt. And with said dirt as collateral, we’ve been pre-approved for an $850K construction loan. So we know we can cover rebuilding costs.

But $850K?

Yep. The building industry talks about things in terms of price per square foot. Today, in Boulder County, it costs between $325 and $385 per square foot to build a house. I know this because I’ve collected anonymized build-out sheets from myriad contractors. I also recorded the Louisville Building Commissioner quoting this range. Oh, and he sent me an email where he wrote it down.

Ok, so it’s going to expensive. But we still haven’t gotten the mortgage out of the picture.

In the first offer, our insurance adjuster said the replacement cost of our Dwelling was $528K. And after shaving off 40% because, you know, depreciation-and-stuff, we’re left with ACV of $320K. That is not enough to pay off our mortgage; we’re off by $157K.

Here’s a copy of our first offer from the insurance company.

Pushing up Replacement Cost Value

So, I shared all these wonderful build-out sheets, including the recording from the Louisville Building Commissioner and his email, with our adjuster. If we believe all this data, the Replacement Cost Value should be around $821K (2,348 square feet X $350 per square foot). And I told her that’s what we’re pushing for. If we start there, with what it will actually cost to replace the Dwelling, and take off that 40% for Recoverable Depreciation, we’re left with an ACV check of $510K.

That gets rid of our mortgage.

But, she doesn’t believe these numbers. Or, at least, “Management” doesn’t. They did come back with an improved Replacement Cost Value of $665 and ACV check of $406K based on this data. So there’s some progress. But I’m struck by how much effort I need to put into this. Shouldn’t the adjuster be on my side (ha)?

Stalemate

Now we’re at a stalemate. According to Homesite, our only recourse it deliver two detailed build-out sheets from two different builders, where each corroborates the higher cost per square foot. The level of detail needs to approximate what Xactimate spits out. Here’s but a fraction of what that looks like:

Steel rebar - #10 (1-1/4"): $664.11

Concrete slab on grade - 4" - finished in place: $945.24

Concrete dye - additional charge: $69.40

Skid steer loader and operator: $2,536.80

Seal & paint - wood fence/gate: $55.81

The Homesite Xactimate offer has 29 pages of this stuff. It’s like they’re trying to ground us into submission through pedantry.

Wish us luck.

In my several decades of helping friends argue with insurance companies after incidents, I have never experienced anything but a reward for being the squeaky wheel. It is simply a waiting game where they expect you to take the easy money and close their file. The longer the file remains open the more power you have since they have quotas and computer systems red flagging files that stay open for too long and pushing them to close them. Stick to your guns! Eventually they will settle.

Thank you for sharing your story. This is really helpful to us because we are also going through this and want to know what to expect. Keep pushing--it is not right that companies wrote policies that were too low and are even now seeking to lowball us and keep from providing fair payment.