Insurance, Round II

Or, an account of how we pushed our ACV up.

I know you’ve been following along intensely. So you’ll easily recall when we got to know each other really well after I “revealed all” about our insurance and mortgage situation. We did some work since then to move past the stalemate and got an additional 22% increase to our original ACV payout. So far, we’ve been able to adjust our ACV upward by 48% from $320,325.94 to $475,891.25. It has taken a lot of work. But these adjustments have made it possible to pay off our mortgage and get them out of the rebuilding process.

And no, we’ve not used a public adjuster.

Terms of import.

First, let’s review some important terms:

Replacement Cost Value (RCV): The amount of money the insurance company believes it’ll take to get something of like kind and quality back in today’s market. If we bought a refrigerator in 2015 for $1,500, that model might sell today for $2,300. So, RCV is $2,300.

Actual Cash Value (ACV): If you’d sold that six-year-old refrigerator the day before the fire, this is amount the buyer would have paid. Given the age of the thing, a buyer might have paid $500 for it on 29 Dec 2021. $500 is the ACV.

Recoverable Depreciation: The difference between Replacement Cost Value and Actual Cash Value. Age, which leads to depreciation, is a proxy for the gap. Back to our refrigerator, Recoverable Depreciation would be $1,800. Basically, the older the thing is, the higher the Recoverable Depreciation value.

Insurance companies write a check addressed to you and your mortgage company for the ACV amount. You can go back to them asking for Recoverable Depreciation as you incur costs while building, or if you buy a house. For example, if we actually spend $2,300 to get a new fridge, we can ask for that $1,800 RCV by sending them a receipt. And that’s a bureaucratic cash-flow conundrum we’d like to avoid. ACV is king since we get the money now instead of having to pay out of pocket and get reimbursed later.

Chimney flashings. Oh my.

So, last time we talked about this, our insurance company asked for detailed quotes from two different builders if we wanted to increase ACV. Detailed quotes are helpful for challenging and increasing the Replacement Cost Value of detailed Xactimate offers from insurance companies. And if we get Replacement Cost Value up, ACV will go up, too.

For example, if the insurance company believes it’ll cost $431 to get a new “Chimney flashing,” and that ours was 30 years old, ACV for it is $125.26. But, if a builder quote says “No, no no. Chimney flashings are going for $600 these days,” (they’re not), ACV goes up to $172.69.

But without a builder’s quote, I have no leg to stand on to challenge our insurance company’s estimates for how much things cost to replace. So what leg can I stand on?

The actual age of our things. That’s our leg. Let’s go after Recoverable Depreciation. Eureka.

Substantiating the actual age of our things.

Our insurance company made the broad assumption that almost everything in our house, and thus the 212 items in their estimate, was 30 years old. It was built in 1992, and 2022 - 1992 is 30. Ok.

But the previous owner did a remodel circa 2010. We replaced our roof in a hail storm in 2018 and also repainted the exterior in 2021. So if I could prove things were newer, I could make a serious dent in Recoverable Depreciation and increase that ACV amount.

Louisville has a portal, and with it I requested the full permit history for our house. The city responded within an hour with documentation. And with it I was able derive dates for a lot of things. For example, the basement was finished in 2006, not 1992. The permit for our new roof was there, too, corroborating that 2018 date. And I found a permit for window replacements that happened in 2005 that I didn’t now about.

But nothing was there for the kitchen and living room remodel, which I knew happened since details about it were prominent in the MLS when we bought the house in 2017:

Stunning remodel boasts numerous updates: Bosch appliances, solid cherry cabinets, granite counter tops, custom back-splash, double-sided fireplace, Pennsylvania slate & much more!

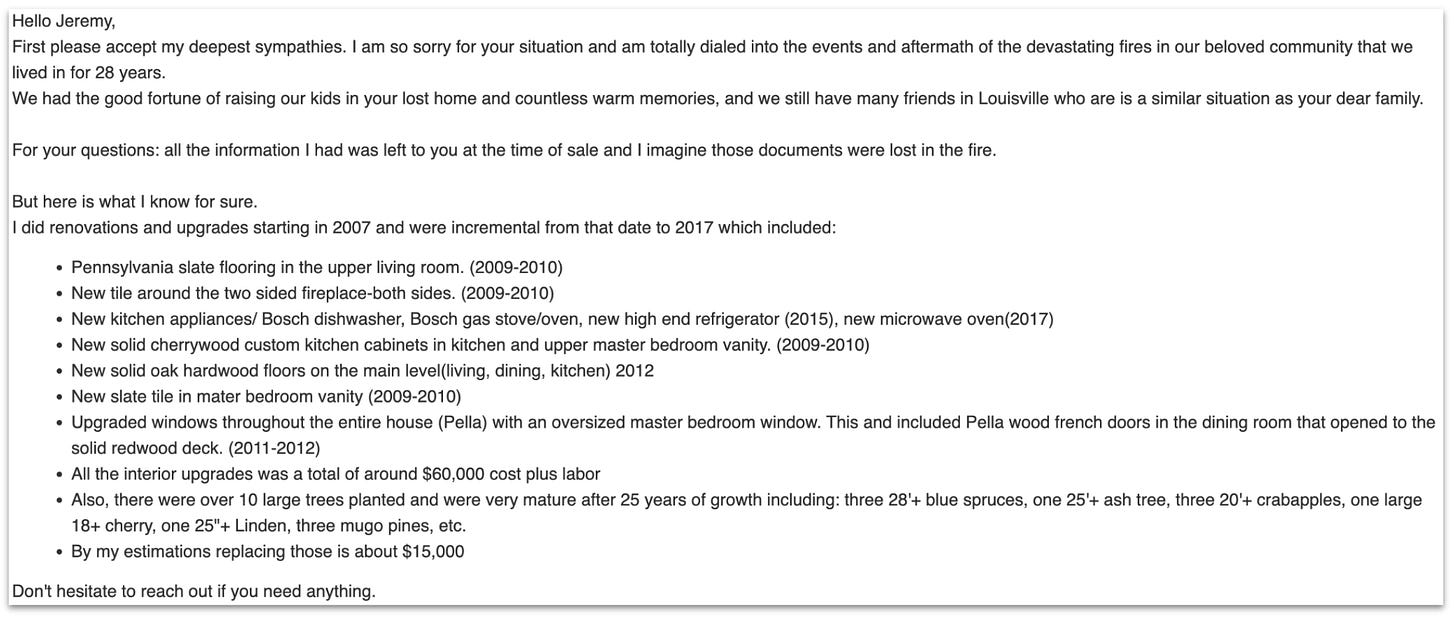

John, our neighbor, had the email address of the original owner. On a whim, I emailed him about our situation. And he sent a prompt, thoughtful response expressing his condolences and finishing it off with a bulleted list of all the upgrades they made and when.

I took a screenshot of the list hoping our insurance adjuster would accept it as evidence, too.

She did.

Tabulating the results.

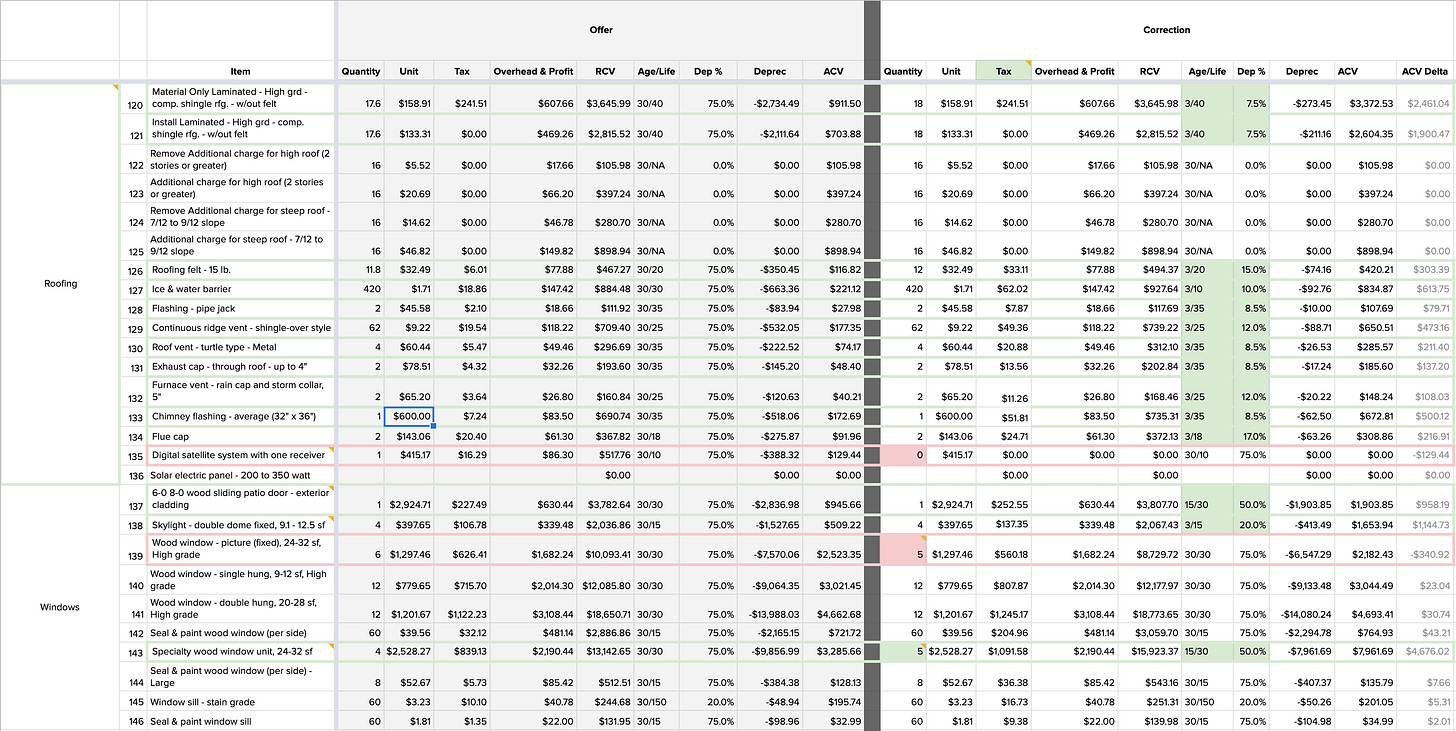

With evidence that assumptions about age for a lot of expensive items were wrong, I manually copied and pasted each of the 212 line items from our Xactimate estimate into a spreadsheet. I then reverse-engineered their functions to figure out how they were calculating things like taxes and Recoverable Deprecation. It took me about 8 hours do do all that data entry, find the deltas and prove them to be deltas.

On the left was their estimate. On the right was my correction. I highlighted each corrected item in green if it was upward, or red if it was downward. I also provided a link, via comment on the item name, to supporting documentation.

I also discovered their program had asserted an 8.2% sales tax rate, and not the 8.635% sales tax rate that went into effect in Louisville this year. Sales tax is part of the RCV amount, and I was able to find small tax-based adjustments across the board.

Our insurance company had given us credit for things we didn’t have, like crown moulding, two ceiling fans (we had one), and a digital satellite receiver. So, to be fair, I called these out as downward adjustments and highlighted them in red.

In the end, I was able to show we were owed another $67,025.85 in ACV. I sent the spreadsheet to our adjuster, and she promised to review it and get back to us by March 4th. And, promptly, on March 4th, she responded accepting all our changes, and had bumped ACV a little higher to $70,027.86.

My response to her was “Amazing!”

If it’s helpful to anyone out there who might be considering this, here’s the sheet I compiled. It’ll also give you a sense of what level of evidence we needed to support these adjustments.

ACV adjustments to-date.

There’s still another $480K that we can get from our policy. Much of it is still wrapped up in Recoverable Depreciation with the Dwelling portion of our claim, which we plan on tapping into as we rebuild.

Here’s a short chronology of how we increased our Dwelling ACV:

First ACV adjustment: ACV adjusts by $85,537.45 from $320,325.94 to $405,863.39. We provided evidence that cost to rebuild was between $325 and $350 per square foot (see “Pushing up Replacement Cost Value” here). This challenged their assumptions, and they tweaked their estimate responding with an ACV increase of $85,537.45.

Second ACV Adjustment: ACV adjusts by $70,027.86 from $405,863.39 to 475,891.25. This spreadsheet is what did it. And with this adjustment, our total ACV payout is $475,891.25. Mortgage paid off!

Onward!

With our mortgage paid off, we’re the proud owners of a plot of dirt. And this clears the way for a construction loan as our financing vehicle for a new house. Onward!

Fascinating! You da man Jeremy!!

Outstanding work, Jeremy! I hope your entire community is following along and uses this information to help them in their battle.